Would enter the below order details with an action type of “Buy to cover” in order to close, or “cover” my short position.Ĭan I Use the Proceeds from a Short Sale?

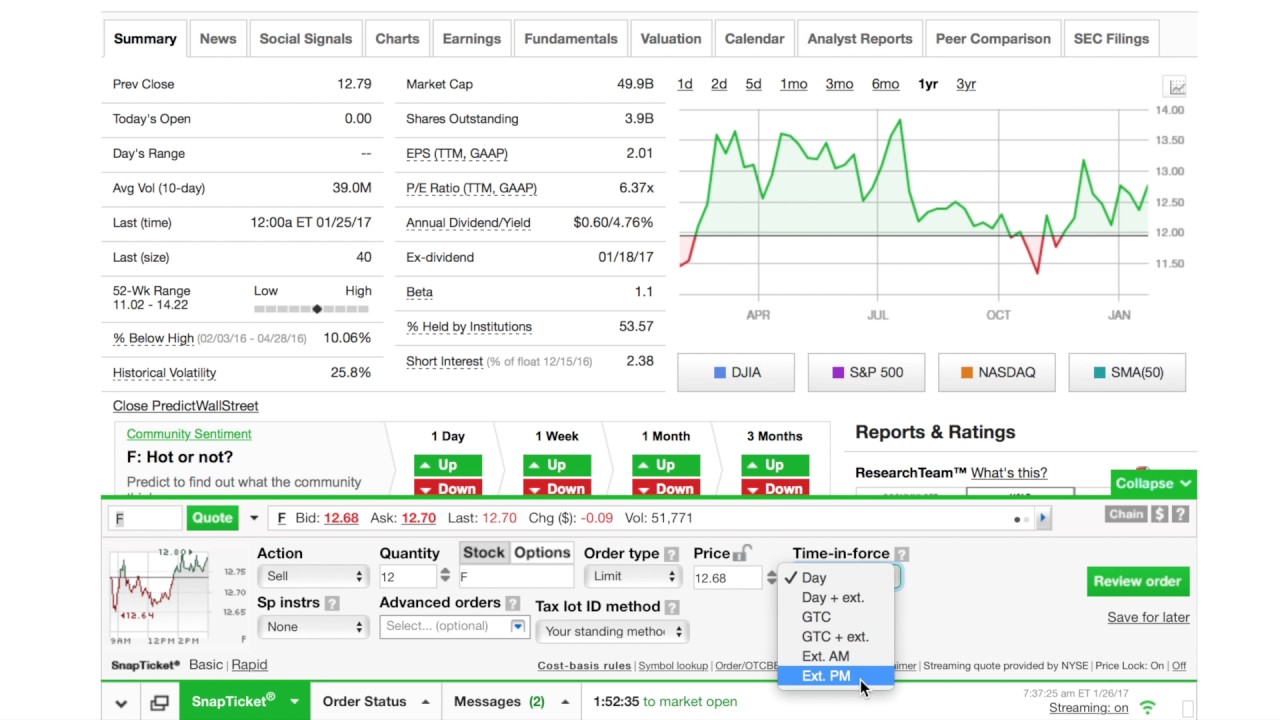

That’s where we would like to close my short position, locking in a gain of $28.40 per share, or $2,840 total. Let’s say TD Ameritrade filled my AAPL short order above, and that we expect tomorrow’s AAPL earnings report to be a disaster, bringing the share This means we would like to sell 100 shares of AAPL for total proceeds of $15,340 or more. In the below example, you can see that we are looking to sell short 100 shares of AAPL with a limit price of $153.40 per share. Placing a short sell on TD Ameritrade is similar to how you would place a standard long trade, except you will select “Sell short” for the action. How Do I Place a Short Sell on TD Ameritrade? $0 stock/ETF trades and a transfer fee refund. The broker does not allow shorting of OTC stocks (i.e.

TD Ameritrade must also be able to locate shares for you to borrow before you can short a stock. The equity required to maintain your short position may vary based on the market price of the security you shorted, and if the short position movesĪgainst you your account could face a margin call, requiring you to deposit additional funds. In order to short sell on TD Ameritrade, you must have a margin-enabled, non-retirement account with at least $2,000 in marginable equity. What Are TD Ameritrade’s Requirements on Short Selling? There is no special pricing or surcharges for short selling stocks or ETFs on TD Ameritrade.

Short a stock, your broker is essentially lending you the shares that they or another investor holds so that you can then sell them.Ĭlose the short position, you are buying the shares that you borrowed back from the open market (hopefully at a lower price) and TD Ameritrade This article will walk you through the process of short selling on TD Ameritrade.Īs we mentioned above, to short sell a stock is to make a bet that its price will go down from where you shorted it. It allows them to profit from both the good and bad companies they’ve researched. Who spends a lot of time researching individual companies, the ability to short a stock can lead to more opportunities and more gains. Especially from the perspective of a fundamental investor, The ability to short a stock (to bet that it’s price will go down) can be a powerful tool to add to any portfolio. TD Ameritrade Short Selling Stocks: Fees and How to Sell Short in 2023 Does TD Ameritrade offer short selling on stocks and ETFs? How to sell

0 kommentar(er)

0 kommentar(er)